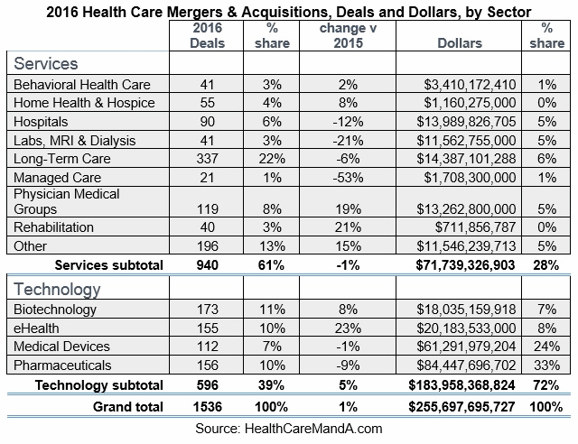

As health care mergers and acquisitions go, 2016 lived up to the predictions that M&A activity would stay strong. Preliminary data for year-end totals shows 1,536 announced transactions across 13 healthcare sectors. The total represents a 1% increase in deal volume compared with 2015. (See chart below.)

Spending on those deals was significantly lower than the previous year, at least for now. The combined total spending in 2016 now stands at $255.7 billion, down 36% compared with 2015’s $400.3 billion. Nearly $100 billion of that total now hangs in the balance, as two of 2015’s largest deals (Anthem/Cigna and Aetna/Humana) await decisions from a federal judge regarding their outcome. The trials wrapped up early in 2017 and decisions could be announced any day.

A few sectors made gains on their 2015 performances. The strongest was the eHealth sector, up 23% in deal volume in 2016, to 155 announced transactions. Tw0 services sectors, Rehabilitation (+21%) and Physician Medical Groups (+19%) had strong increases. Private equity firms have made no bones about their interest in the Rehab sector, which led to a lot of acquisition activity in 2016. Thanks to the Medicare Access & CHIP Reauthorization Act (MACRA), many doc groups that hoped to stay independent were convinced it was time to team up with larger practices, or even the local hospital.