Drug manufacturers came under heavy scrutiny late in 2015, both for their pricing practices and their penchant for acquiring overseas rivals to gain lower corporate tax rates. The latter issue was the major impetus for the lrgest health care deal ever announced, Pfizer‘s (NYSE: PFE) $160 billion takeover of Dublin-based Allergan plc (NYSE: AGN). The Treasury deparment moved quickly to change its rules on “inversions,” making them even more onerous. Pfizer walked away from the deal, not surprisingly. Public sentiment about the high price of many drugs, including generics, is having a chill effect on this sector. 2016 may turn out to be a quiet year for pharma deals, at least until the presidential election is over in November.

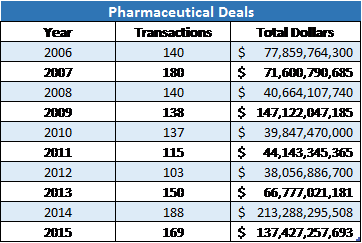

Pharmaceutical Deals, 2006 to 2015

by | Apr 20, 2016 3:50 pm | Pharmaceuticals

Categories

- Ambulatory Surgery Centers

- Behavioral Health Care

- Biotechnology

- CDMO

- CRO

- eHealth

- Healthcare M&A News Leads

- Healthcare Market Updates

- Healthcare Staffing

- Healthcare Staffing

- Home Health & Hospice

- Hospitals

- Laboratories, MRI & Dialysis

- Life Sciences R&D

- Long-Term Care

- Managed Care

- Medical Devices

- Medical Office Buildings

- Medical Outpatient Buildings

- Occupational Health

- Other Services

- Outpatient Surgery Center

- Owner Snapshots

- Pharmaceuticals

- Physician Medical Groups

- Private Equity

- Rehabilitation

- SPAC

- Specialty Pharmacies

- Specialty Pharmacy

- Uncategorized

- Urgent Care Centers