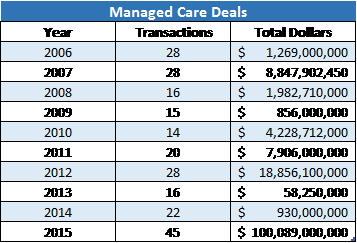

The managed care sector surged back to life in 2015, with deal volume growing 104%, to 45 transactions. Enrollment for health insurance continued to climb, albeit slowly, through the federal and state healthcare exchanges, which made managed Medicare and Medicaid companies appealing targets. The big moment came in late June, when the U.S. Supreme Court handed down its decision in King v. Burwell, upholding the use of subsidies to people who enrolled in healthcare coverage through the federal exchange, Healthcare.gov.

Almost immediately, Centene Corp. (NYSE: CNC) announced its intention to buy Health Net for $6.8 billion. That deal was soon dwarfed by Aetna’s (NYSE: AET) proposed buyout of Humana Inc. (NYSE: HUM) for $37 billion, and by Anthem’s (NYSE: ATHM) $54.2 billion deal for Cigna (NYSE: CI). While the Centene/Health Net transaction closed in March 2016, the larger two are still undergoing scrutiny from state and federal regulators. There’s no telling how long the approval process will take, and no guarantee it will prove successful for all parties involved.