by Lisa Phillips | Oct 6, 2017 6:08 pm | Healthcare Market Updates, Long-Term Care

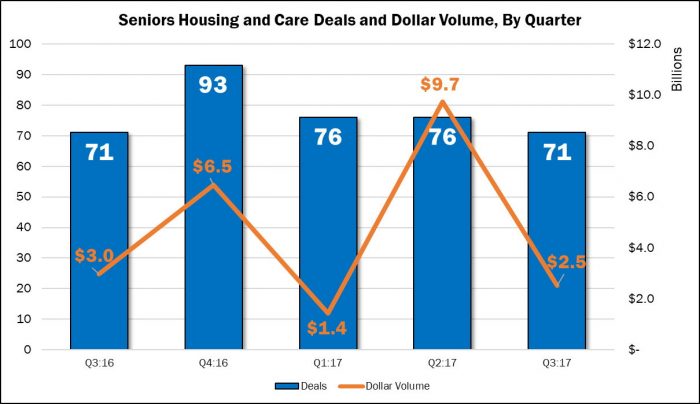

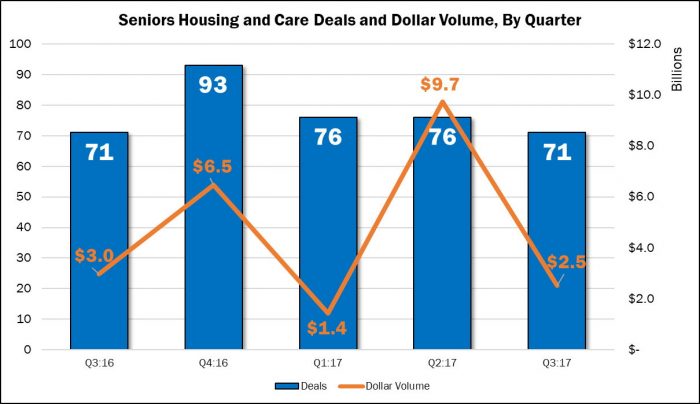

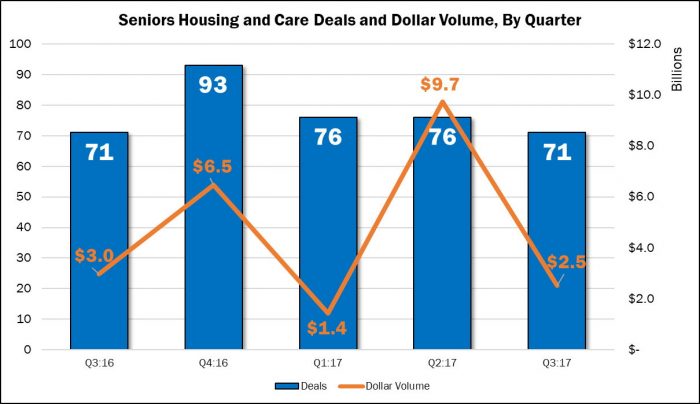

We will be addressing the quarterly seniors housing and healthcare M&A results in Health Care M&A Quarterly Report, which covers all 13 health care sectors. But, here is a preview: Although it remained above 70 deals for the quarter, seniors housing and care M&A activity fell to a year-low, tying with last year’s third quarter at 71 publicly announced transactions. Dollar volume also fell from its recent peak of $9.7 billion in the second quarter of 2017, recording $2.5 billion in transaction value based on disclosed prices. Increasingly, we have seen buyers prefer the one-off deals that come with one or two properties. Those deals are easier to complete and are most... Read More »

by Lisa Phillips | Jul 28, 2017 2:21 pm | Long-Term Care

Merger and acquisition activity stayed virtually even in the second quarter, down 1% from the previous quarter, to 75 transactions. The quarter’s deal volume makes up 24% of the 315 deals announced within the past 12 months. Q2:17’s deal volume is 17% lower than the same period a year earlier. Source: HealthCareMandA.com, July 2017 Based on revealed prices, approximately $9.7 billion was committed to finance second quarter deals, an increase of 574% compared with the previous quarter and 299% higher than the same period in 2016. The second quarter accounted for 47% of the $20.6 billion spent in the last 12 months. Forty-four of the 75 deals disclosed prices, and two were more than $1... Read More »

by Lisa Phillips | Jul 14, 2017 7:21 pm | Long-Term Care

The dollar volume of publicly announced seniors housing and care acquisitions in the second quarter of 2017 surged to $9.7 billion, a nearly 600% increase over the first quarter’s volume of $1.4 billion. The number of announced transactions in the second quarter (75) was basically even with the first quarter (76), according to new acquisition data from HealthCareMandA.com. The dollar volume is the highest since the second quarter of 2014. Driving the dollar volume were two billion-dollar acquisitions, including the acquisition of Care Capital Properties by Sabra Health Care REIT in a transaction valued close to $4.0 billion, as well as the acquisition of Hawthorn Retirement Group by... Read More »

by Lisa Phillips | Jun 9, 2017 7:28 pm | Behavioral Health Care, CRO, eHealth, Home Health & Hospice, Hospitals, Laboratories, MRI & Dialysis, Long-Term Care, Managed Care, Medical Devices, Other Services, Pharmaceuticals, Physician Medical Groups, Rehabilitation

Preliminary data for the month of May shows an encouraging uptick in deal volume, with the services sectors making up 66% of the total. Some 134 transactions were announced last month, a 30% increase over April’s anemic 103 deal volume total. But monthly transaction totals in 2017 are not keeping pace with those in 2016. A year ago, 151 transactions were announced, 11% higher than in May 2017. There’s no question that the ongoing uncertainty surrounding the American Health Care Act hangs heavily on healthcare investors. The Senate Republicans have been at work behind closed doors to craft a different deal than the one sent to them by the House Republicans in mid-May. From the handful of... Read More »

by Lisa Phillips | Jun 3, 2016 7:04 pm | Hospitals

The lawsuits may go on, but the facilities that once belonged to the physician-owned chain of six hospitals In Texas are now in new hands. Each filed for Chapter 11 bankruptcy protection at different times, beginning in September 2015, and were sold in separate auctions. On February 18, Sabra Health Care REIT (NASDAQ: SBRA) unloaded Forest Park Medical Center at Frisco for $96.25 million to HCA North Texas, a subsidiary of HCA (NYSE: HCA). The REIT had paid $119.8 million to acquire the 54-bed hospital in October 2013. The hospital initially relied on out-of-network fees for procedures, but that revenue stream dried up as insurance companies created their own in-network contracts. The... Read More »