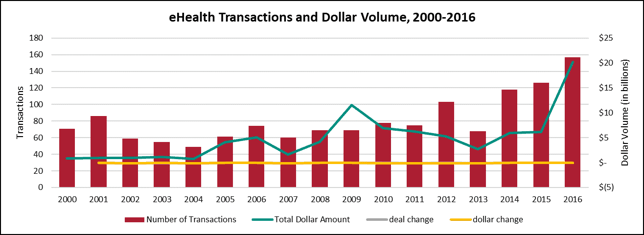

Mergers and acquisitions in the eHealth sector are surging, and data is driving some of the biggest deals in health care. Deal volume in the digital health space went from 68 transactions in 2013 to 157 announced in 2016, a 131% increase. Transaction levels remained in the double-digits from 2000 until 2012, when 103 digital deals were recorded. Since 2014, when annual deal volume reached triple-digits, M&A has grown almost exponentially.

Dollar volume shot up as well, growing from annual totals in the hundreds of millions early in the century to seven-figure totals beginning in 2005. The $11.5 billion total logged in 2009 was something of a milestone. The $20.2 billion total posted in 2016 is a record.

The eHealth sector is only beginning to get its act together. Mary Meeker, the Internet guru at Kleiner Perkins, presented her annual Internet report in May 2017. For the first time, she included a section looking at the healthcare industry’s use of digital data. Her conclusion is that the industry is at a digital inflection point.

Today, digital healthcare data is taken for granted. It comes in the form of 3D and digital x-rays, wearable ECG monitors, digital blood pressure cuffs tied to smartphone apps, blood glucose monitors and remote hospital or home-patient monitoring. The area of diagnostic technology has grown rapidly, from 13 commercially available lab tests in 1993 to 59 tests in 2017, and that’s only through May 1.

Data inputs are accumulated and analyzed, which gives rise to insights, Meeker’s report noted. Translating those insights impacts delivery of healthcare and development of new therapeutics. The outcomes are measured and iterated, which gives rise to more innovation and compresses the time to arrive at the next cycle of innovation.

If that sounds too ephemeral, consider this data, also in the report. In 2013, a typical 500-bed hospital had 10,000 desktop computers, 500 owned or controlled tablets and 2,000 owned/controlled mobile devices, all generating 1,000 different interfaces with the 8,000 employees and myriad patients. That digital equipment generated 50 petabytes of data per hospital per year. (One petabyte equals 1 million gigabytes, as you know.)

Adoption of electronic medical records was already beyond the saturation point in 2015, when 87% of office-based physicians reported having such a system. Typical data stored in those records were clinical results, scanned images, vital signs, current and historic health problems and other information such as medications and allergies.

Small wonder then, that private investors, particularly private equity firms, are piling into the digital health sector to acquire companies with systems that integrate revenue cycle management, billing, medications and payer information that managed care companies can use to build proprietary population health management platforms. The goal is bending the cost curve, by monitoring patients with chronic conditions in the hopes of preventing costly medical interventions.

Big Deals in 2016

Big money is being spent on data aggregation and analysis. In fact, the two largest deals in this century involved the same target – IMS Health Holdings. In 2009, TPG Capital and the CPP Investment Board of Toronto took IMS Health, Inc. private for $5.2 billion, consisting of $4.0 bill in cash and $1.2 billion in assumed debt. IMS shareholders received $22.00 in cash for each share.

The attraction was IMS Health’s trove of business intelligence, including information, analytics and consulting services provided to the pharmaceutical and health care industries. The deal offered IMS Health shareholders a premium of nearly 50% to the closing price on October 16, 2009, the day before public speculation that the company was considering its strategic alternatives.

IMS Health went public again in 2014, priced at $20.00 per share that April. The company was now a global information and technology services company, providing healthcare clients with solutions to measure and improve their performance. It still had one of the largest and most comprehensive collections of healthcare information in the world, covering sales, prescription and promotional data, medical claims, electronic medical records and social media.

Little surprise, then, that Quintiles Transnational Holdings (NYSE: Q) offered $12.8 billion to acquire the company in May 2016. Quintiles provides biopharmaceutical development services and commercial outsourcing services worldwide. The price Included assumed long term debt of $4.14 billion. IMS shareholders received 0.384 shares of Quintiles common stock for each share of IMS common stock.

The combination of Quintiles’ clinical trial expertise with IMS’ global information solutions data and technology services was anticipated to improve clinical trial design, recruitment and execution in the $100 billion biopharma product development market.

Another global information powerhouse, IBM (NYSE: IBM), announced the second largest digital deal in 2016, with a $2.6 billion price tag. Its target was Truven Health Analytics, a portfolio company of Veritas Capital. Truven provides cloud-based healthcare data, analytics and insights to more than 8,500 clients, including federal and state government agencies, employers, health plans, hospitals and life sciences companies.

IBM’s goal was to integrate Truven’s extensive cloud-based data set with its Watson Health Cloud, creating one of the world’s largest and most diverse collections of health-related data, aggregating approximately 300 million patient lives. Truven’s data informs benefit decisions for one in three Americans.

This was IBM’s fourth major health-related data acquisition since April 2015. Veritas Capital acquired Truven Health from Thomson Reuters Corp. (NYSE: TRI) in 2012 for $1.25 billion.