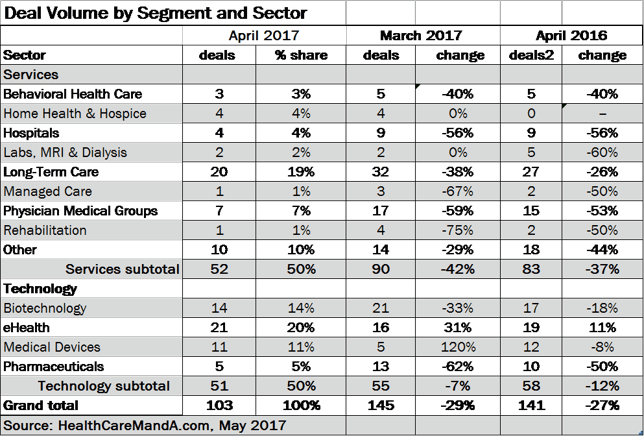

April usually doesn’t feel like February, at least, weather-wise. As far as healthcare mergers and acquisitions go, however, deal volume in April 2017 (103 deals) feels a lot like February’s deal volume (102). The chart below shows the clear winners and losers in April 2017.

Deal volume was down 29% compared with the previous month (March, 145 deals), and slid 12% compared with the year before (April 2016, 141 deals).

Healthcare services deal volume accounted for just 50% of April’s preliminary total. The services sectors typically account for higher percentages than the technology sectors (although that trend is reversed when it comes to dollar volume). The services side accounted for 62% of the deal volume in March 2017, and 59% in April 2016.

Every sector but two, eHealth and Home Health & Hospice, suffered a loss compared with April 2016. The eHealth sector is relatively immune to repercussions from replacement of the Affordable Care Act, which is still being debated in the House of Representatives. The move to value-based care and reimbursement relies on technology to gather and analyze myriad data points to show proof of improved patient outcomes. Revenue cycle management, electronic medical records, population health management also rely on data systems to gather and crunch numbers.

For Home Health & Hospice, the sector rarely sees double-digit deal volume on a monthly basis. Even as Kindred Healthcare (NYSE: KND) left the skilled nursing market to focus on home health and hospice, the Mayo Clinic Health System announced plans to phase out its home health services in a few Minnesota towns.