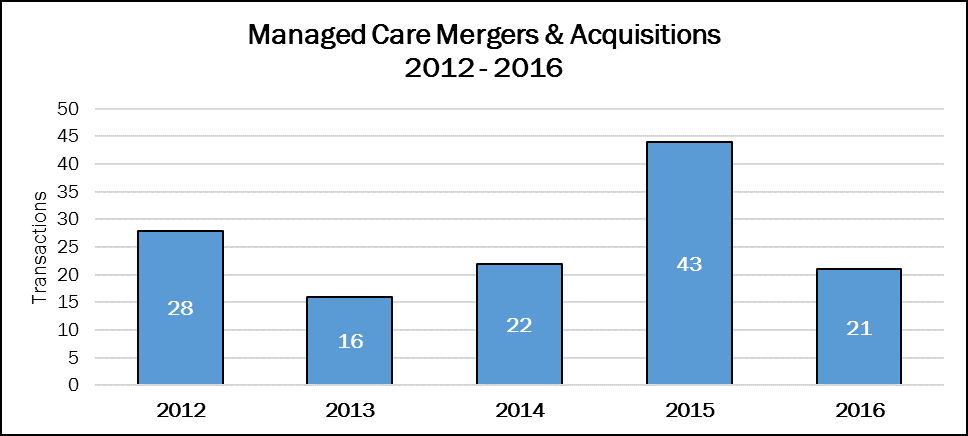

Mergers and acquisitions in the Managed Care sector had a good run back in 2015. Since then, it’s been slow going for deal makers.

Following a hot streak of transactions in 2015, M&A activity didn’t just trail off in 2016, deal volume cratered—down 52%, to 21 transactions. The recent high of 43 deals announced in 2015 has been revised downward, and will be again by the end of the year.

The mega-deals of 2015, announced between Aetna (NYSE: AET) and Humana (NYSE: HUM) at $37 billion, and Anthem (NYSE: ATHM) and Cigna (NYSE: CI) at $54.2 billion, have been blocked on antitrust grounds by two federal judges. In February 2017, Aetna and Humana called off their merger, and the figures shown here represent that event. Anthem says it is still moving ahead with its acquisition of Cigna, even though the target has announced it has terminated their agreement and sued Anthem for payment of the $1.85 billion termination fee and an additional $13 billion in damages suffered on behalf of its shareholders. That deal is still included in these figures.

Only five deals have been announced in the first quarter of 2017, as the Republican-led Congress tried to repeal and replace the Affordable Care Act with the American Health Care Act. When their initial efforts died in late March, the health insurance industry was left dangling, waiting and wondering what Congress’s next move will be. Talk of more states expanding Medicaid popped up, briefly, until the Republican governor of Kansas, Sam Brownback, vetoed an expansion bill passed by the state legislature.

If deal makers in the Managed Care sector turned out five deals per quarter in 2017, the performance (20 deals total) would nearly match that of 2016 (21 deals). And that would be considered the “new normal.” We won’t know until the House of Representatives revisits the American Health Care Act, something the Speaker is proposing already in April 2017. Stay tuned.