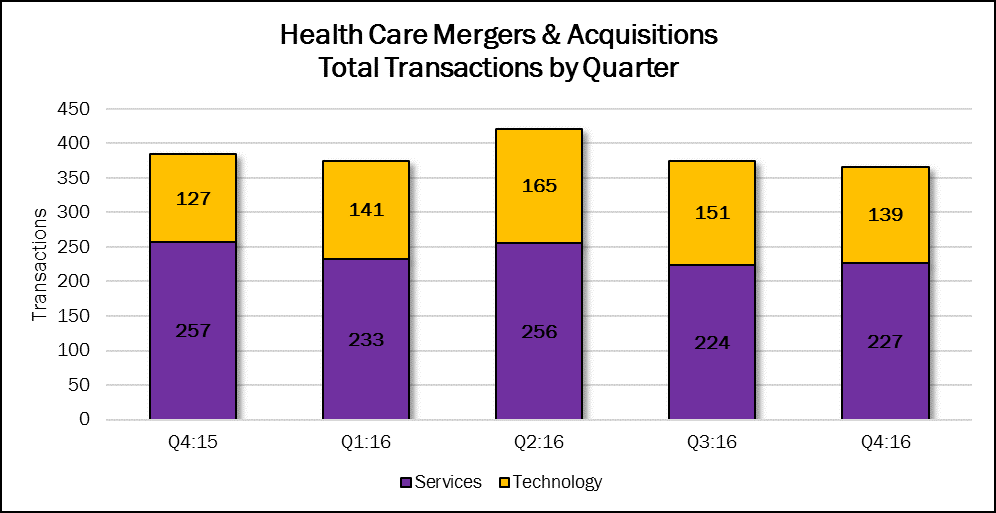

Deal volume has trended downward in 2016, after spiking in the second quarter with a total of 421 deals. The third quarter logged 375 deals, and the fourth quarter’s total slipped 2%, to 366 transactions. These are not major shifts, and every quarter since Q1:14 has reported totals of greater than 350 transactions.

We may be witnessing the beginning of a real downward trend, if enough investors are spooked by the Trump administration and Congress’s efforts to repeal and replace the Affordable Care Act. No replacement plan has been approved as of this writing a week after the inauguration of Donald Trump, although some senators have put forward their own plans to be debated. Healthcare providers, in particular, are in a wait-and-see mode. Let’s hope there is more solid news to report by the end of Q1:17.

Deal value is trending the same way. Deal value in the fourth quarter totaled $37.3 billion, which was 24% lower than the previous quarter, and 16% lower than Q4:15’s $44.4 billion total. Deals on the Technology side of health care typically dominate the spending category, but the fourth quarter was an exception. Technology deals accounted for 49% ($18.4 billion) of the quarter’s spending. The Services sectors contributed 51% ($18.9 billion) of the period’s spending.

Christmas came early for some segments of the healthcare industry. Early in December 2016, Congress overwhelmingly passed the 21st Century Cures Act (94 to 5 in the Senate, 392 to 26 in the House), and then-President Obama signed it.

The National Institutes of Health will receive $4.8 billion in new funding over 10 years. Of that, $1.8 billion is reserved for now-former Vice President Biden’s Cancer Moonshot, and $1.6 billion will fund research into Alzheimer’s and other brain diseases as the BRAIN Initiative. Another $500 million will go to the Food and Drug Administration to streamline the approval process for medical devices and pharmaceuticals.

The bill also gives $1 billion in grants earmarked for the states to deal with the opioid epidemic, and more money will go toward mental health research and treatment. We expect investors will follow the money, and M&A activity will continue to grow in Behavioral Health Care, Biotechnology, Medical Devices and Pharmaceuticals, to name a few sectors.